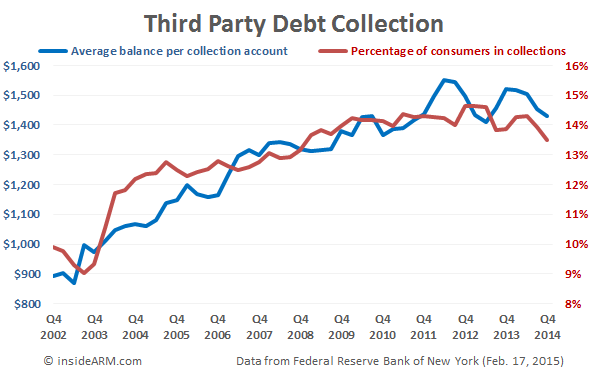

The percentage of Americans with at least one account in the third party debt collection system fell to a post-financial crisis low in the fourth quarter of 2014, according to a report released Tuesday by the Federal Reserve Bank of New York. The average balance of accounts in collection also fell for a second straight quarter.

In Q4 2014, about 13.5 percent of Americans had at least one account in the third party debt collection system, down from 13.9 percent in Q3 2014 and 14.3 percent in Q2. It marks the lowest level for the measurement since Q4 2008, the early days of the financial crisis and recession.

The Federal Reserve Bank of New York’s (FRBNY) Quarterly Report on Household Debt and Credit measures third party debt collection activity – that is, collections not handled by the original creditor – as the percentage of consumers with at least one collection file on their credit report in the past 12 months. The report notes that only a small proportion of collections are related to credit accounts, with the majority of collection actions being associated with medical bills and utility bills.

The report also measures the dollar amount per collection account. That measure also fell in Q4 2014 to around $1,430 from $1,454 in Q3.

The FRBNY Consumer Credit Panel consists of detailed Equifax credit-report data on a nationally representative 5 percent random sample of all individuals with a Social Security number and a credit report (usually aged 19 and over). FRBNY also samples all other individuals living at the same address as the primary sample members, allowing it to track household-level credit and debt for a random sample of U.S. households. The resulting database includes approximately 40 million individuals in each quarter.

The FRBNY Consumer Credit Panel consists of detailed Equifax credit-report data on a nationally representative 5 percent random sample of all individuals with a Social Security number and a credit report (usually aged 19 and over). FRBNY also samples all other individuals living at the same address as the primary sample members, allowing it to track household-level credit and debt for a random sample of U.S. households. The resulting database includes approximately 40 million individuals in each quarter.

Overall, the report showed that total household indebtedness grew $306 billion over 2014 to stand at $11.83 trillion at the end of the year. The figure includes mortgages.

Mortgages and student loans led the way for gains in the quarter, adding $39 billion and $31 billion respectively. Total student loan has separated somewhat from auto loan debt to claim the second-largest debt type at $1.16 trillion compared to $955 billion for auto loans.

Credit card debt stood at exactly $700 billion at the end of the year, up $17 billion for 2014.

Overall delinquency rates were unchanged at 4.3 percent in the fourth quarter, even as delinquency rates for auto loans and student loans ticked up. Slight improvements in delinquency rates for credit cards (7.3% in Q4 vs. 7.5% in Q3) and mortgages offset the rises in student loan and auto loan delinquencies.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)