The U.S. Labor Department early Friday said that non-farm payrolls in the country grew by 257,000 in January, slightly more than what analysts had expected. The headline unemployment rate actually increased to 5.7 percent from 5.6 percent in December. But that, combined with other data released, is a positive development in one of the best jobs reports in decades.

Analysts and economists had been expecting around 237,000 jobs to be added in January and for the unemployment rate to tick down to 5.5 percent. The jobs number itself was roughly on-point, but the unemployment rate moved the other direction as many more people entered (or re-entered) the workforce, an encouraging sign and a reversal from the recent trend.

The expectations for job growth were tempered by recent layoffs in the oil production industry, a reaction to the plummeting price of crude. And indeed, the oil and mining industry saw job losses in January.

But that was one of the few industries that contracted in the month. Job gains were broad across a variety of industries: retail added 46,000; construction jobs grew by 39,000; healthcare employment was up 38,000; professional and technical services grew 33,000; and manufacturing jobs were up 22,000.

The segment which saw the most job losses in January was government, which lost 10,000 in the month.

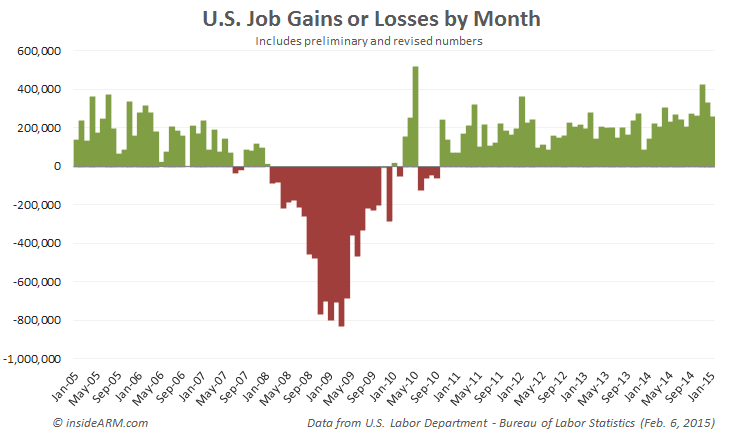

As solid as the report was for plain job growth, it was the previous months’ revisions that made it historic. The Labor Department revised November and December job growth up by a nearly unprecedented 147,000. With the revision to November’s numbers – 423,000 jobs added — it makes that month the single best month for job growth in nearly two decades, with the only exception being the 2010 Census hiring that resulted in an unnaturally high reading in May 2010.

The American workforce grew by 703,000 in January, reversing a years-long trend of decline. The labor participation rate ticked up to 62.9 percent after steady declines; this moved the headline unemployment rate up to 5.7 percent for the month, an unexpected increase.

The American workforce grew by 703,000 in January, reversing a years-long trend of decline. The labor participation rate ticked up to 62.9 percent after steady declines; this moved the headline unemployment rate up to 5.7 percent for the month, an unexpected increase.

This move signals that more people are confident enough in the job market to officially re-entered and resume their search for jobs.

But even that isn’t the key figure for the debt industry in this report. While more people having more jobs, and even more people seeking out jobs, is good for the prospects of debt repayment, workers still need to get paid to resolve their debts. For months, wage growth has been maddeningly slow, even contracting in December.

That all changed in January with the report showing a 12 cent – or 0.5 percent – increase in average hourly earnings to $24.75. The increase was enough to push wage growth over the past 12 months to 2.2 percent, above inflation. In contrast, for 2014, wage growth came in under two percent.

While monitoring month-to-month jobs reports can be frustrating and even unproductive for ARM professionals, this particular report is so broadly great that it might signal a turnaround for the labor market, and thus, an improved environment for debt collection effectiveness.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![the word regulation in a stylized dictionary [Image by creator from ]](/media/images/Credit_Report_Disputes.max-80x80.png)

![Cover image for New Agent Onboarding Manuals resource [Image by creator from insideARM]](/media/images/New_Agent_Onboarding_Manuals.max-80x80_3iYA1XV.png)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)