The Federal Reserve said late Friday that U.S. consumers expanded their use of credit cards at the fastest rate in six-and-a-half years.

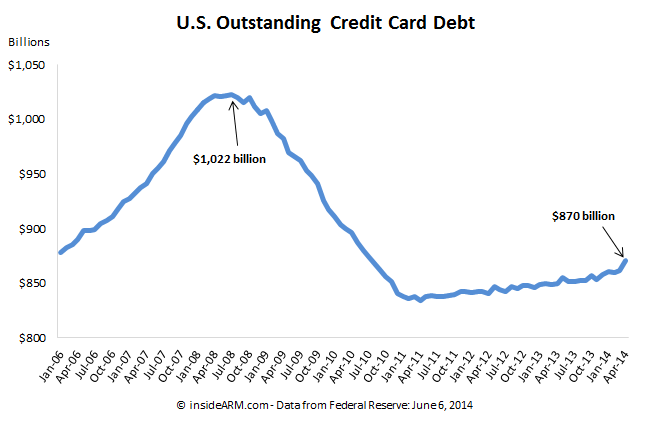

In April, revolving consumer credit – mostly comprised of bank-issued credit cards – grew at an annualized rate of 12.3 percent, the highest rate since November 2007. At the end of the month, total revolving consumer debt outstanding was $870.4 billion, the highest measure since July 2010.

After the financial collapse of late 2008, banks charged close to $200 billion in consumer credit card debt over the next two years, sending the total outstanding measure down faster than it had grown in the expansionary times of early to mid 2000s.

After bottoming out in late 2010, credit card debt has grown steadily, but at a very slow rate.

Overall, consumer credit in April grew at a 10.2 percent annualized rate. Non-revolving debt – mostly comprised of student and auto loans – expanded at a 9.5 percent rate. Non-revolving debt outstanding stood at $2.3 trillion.

Overall consumer credit outstanding is $3.175 trillion.

![[Image by creator from ]](/media/images/patrick-lunsford.2e16d0ba.fill-500x500.jpg)

![[Image by creator from ]](/media/images/New_site_WPWebinar_covers_800_x_800_px.max-80x80.png)

![[Image by creator from ]](/media/images/Finvi_Tech_Trends_Whitepaper.max-80x80.png)

![[Image by creator from ]](/media/images/Collections_Staffing_Full_Cover_Thumbnail.max-80x80.jpg)

![Report cover reads One Conversation Multiple Channels AI-powered Multichannel Outreach from Skit.ai [Image by creator from ]](/media/images/Skit.ai_Landing_Page__Whitepaper_.max-80x80.png)

![Report cover reads Bad Debt Rising New ebook Finvi [Image by creator from ]](/media/images/Finvi_Bad_Debt_Rising_WP.max-80x80.png)

![Report cover reads Seizing the Opportunity in Uncertain Times: The Third-Party Collections Industry in 2023 by TransUnion, prepared by datos insights [Image by creator from ]](/media/images/TU_Survey_Report_12-23_Cover.max-80x80.png)

![Webinar graphic reads RA Compliance Corner - Managing the Mental Strain of Compliance 12-4-24 2pm ET [Image by creator from ]](/media/images/12.4.24_RA_Webinar_Landing_Page.max-80x80.png)